By Victor Schramm, CFS®, AIF®Catching Falling Knives: Strange Behaviors of Equity Investors in 2020 Don't Run To Catch A Falling Knife. You'd think that this sound advice would be self-evidently true: Don't run to catch a falling knife. This is 2020, however, and in the current year, I'm done making assumptions about what is and is [...]

By Victor Schramm, CFS®, AIF®Why "Low Volatility" Was not Low in Volatility If I told you a strategy of investing was "Low Risk," wouldn't you be disappointed if it turned out being higher risk than anything else? The market for Exchange Traded Funds (ETF's) has reacted with similar disappointment to the "Low Volatility" stocks in [...]

Hosted by Victor Schramm CFS®, AIF® & Pablo K. LashaToday's Podcast: All about Oil! We've been asked countless times to make podcast episodes, and we've finally gotten around to making a podcast episode. Today, we're talking about what's been happening in oil. Creating yet another podcast with a radio-style format has not been interesting to [...]

By Victor Schramm, CFS®, AIF®"Is Gold a Safe Investment?" Is gold a safe investment right now? I've heard this question countless times in my career and usually around times when the stock market is down a fair amount. I've never been asked this so many times as in the past week. It seems this is [...]

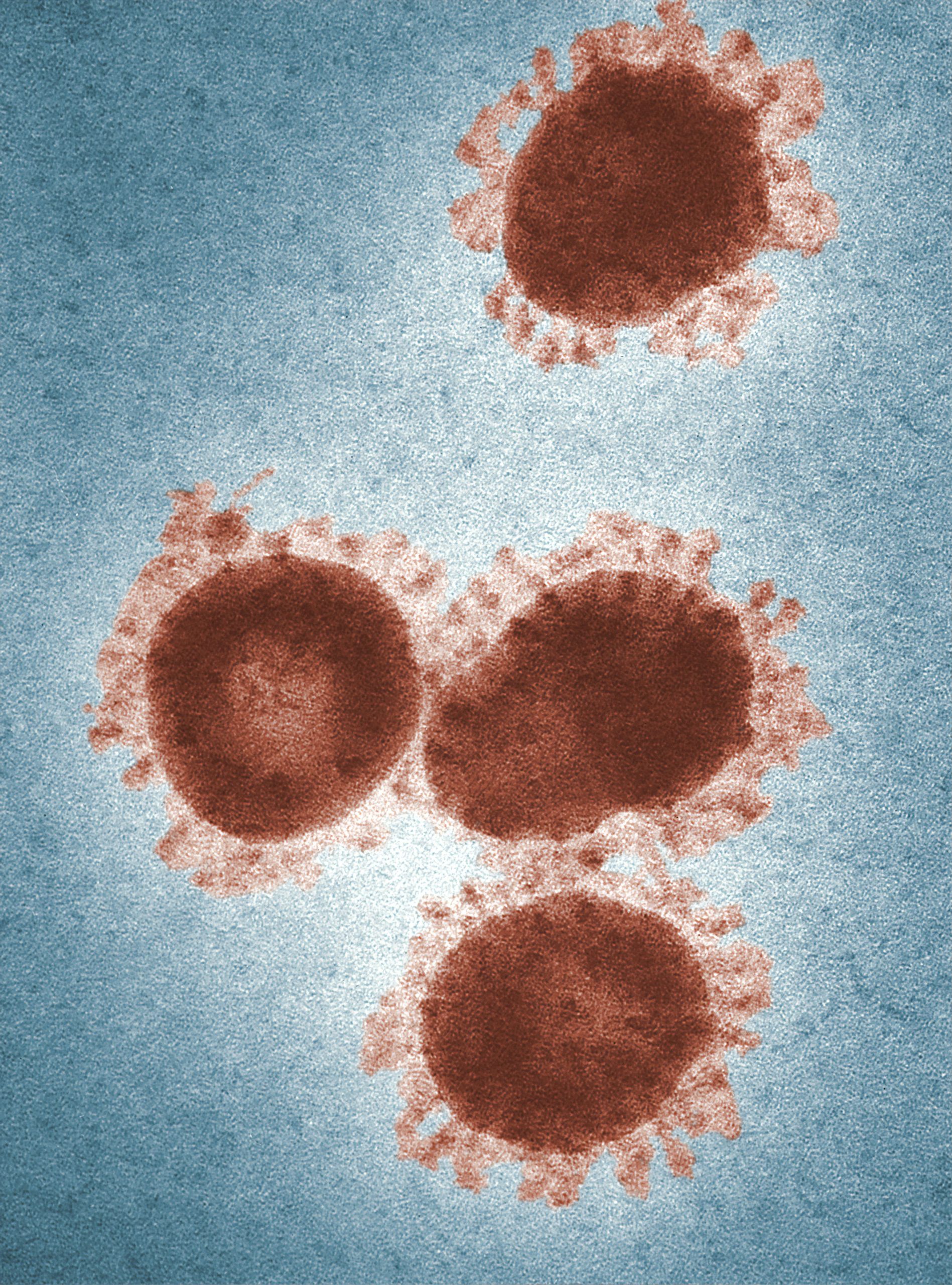

By Victor Schramm, CFS®, AIF®Notes on Coronavirus and Market Volatility The time to buy is when there's blood in the streets.- Baron Rothschild I share the grim epigraph above from Baron Rothschild because it's my favorite quote on investing. Some might be surprised to read that, because I am decidedly uncomfortable with profiting from mass [...]

An Introduction to Factor InvestingBy Victor Schramm, CFS®Introduction Take a look at your brokerage account, IRA, or 401(k). Do you see anything in there with Large Cap, Value, Growth, or Small Cap in the title? If so, you're already investing with Factors. A very large proportion of American households use investments based on Factors but [...]